Our Strategy

Sullivan Street invests in businesses that have underlying stakeholder, operational, or structural complexities in the lower mid-market.

Situations

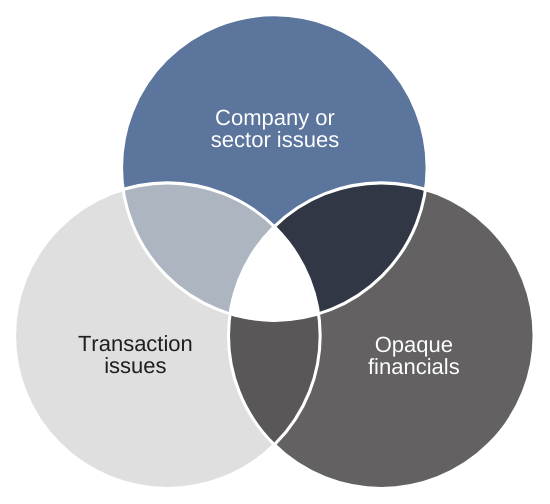

Sullivan Street seeks out complexity in transactions at acquisition with issues that are specific, identifiable, and fixable. With its operational expertise, Sullivan Street takes views that other potential buyers will not be prepared to, looking past the standard diligence to the fundamentals they mask. These situations typically include:

Operational model

Operational expertise at Sullivan Street is not an external resource but is inextricably involved at the highest level in all decision-making processes, risk judgements and structuring discussions. Therefore, the speed with which we can initiate these changes, projects or improvements is radically different from other firms.

Sullivan Street is extremely active in helping businesses in its portfolio improve operationally and works alongside management teams continuously to effect not just transformational change projects but also smaller incremental improvements. Our involvement with our businesses at all levels include:

- Project support – providing dedicated resources for all types of business projects.

- M&A support – M&A work is core to what we do and we assist and lead our businesses’ M&A strategies, diligence and execution.

- Executive support – certain situations necessitate Sullivan Street to step into executive roles within its portfolio companies.

- Shared offices – to ensure daily touchpoints with its portfolio companies Sullivan Street provides dedicated desk space in its central London offices for management teams and employees.

Our holistic model relies on a set of highly interlinked skills and operational competencies and that are inextricable when it comes to decision-making, risk judgement, and structuring discussions. Improving a business’ operations and effectively working alongside management is central to how Sullivan Street work as this model brings about both transformational as well as essential incremental changes.

To date, we’ve established new standalone central functions, developed export opportunities, launched business units, refocused sales propositions, increased productivity, and restructured logistics processes. We commit time and practical support to our portfolio companies and work collaboratively with management to analyse key performance, share the workload, and to ensure needs are not only met but anticipated.

Our investments

Sullivan Street maintains a narrow portfolio to ensure maximum operational focus and support to management teams.