As summer draws to an end, Sullivan Street Partners and the team at The Wave reflect on an active 18 months since the acquisition.

Hazel Geary , CEO at The Wave said: “It has been a great 18 months and we are very proud of the progress being made in Bristol. This summer the weather has been more unpredictable than ever, but as a team we’ve managed the situation well. This is not a challenge to be underestimated given all the planning around staffing and training that is undertaken in the winter. The key is working as a team with the visitor at the heart of our thinking. As always, we are thankful to all our staff and of course to everyone who has visited us!”

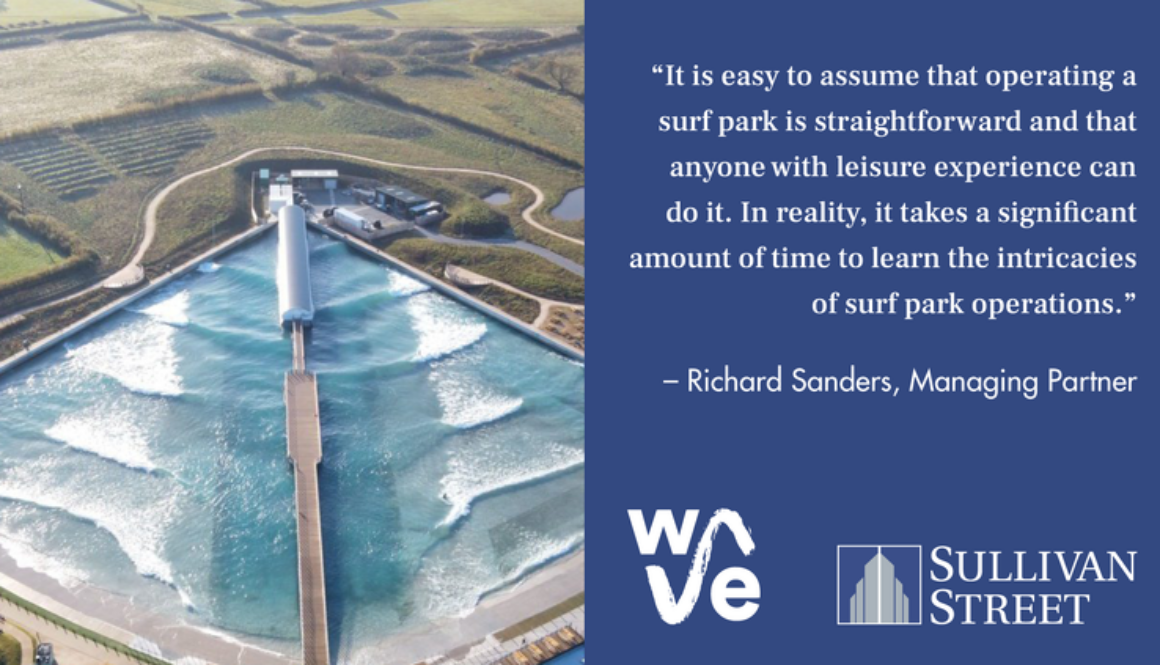

Richard Sanders, Managing Partner at Sullivan Street said: “It is easy to assume that operating a surf park is straightforward and that anyone with operational leisure experience can do it. In reality, it takes a significant amount of time to learn the intricacies of operating a surf park, and there are no easy ways to learn without doing. With lots of surf park developments being planned around the world, we’ve come across many unrealistic business cases being used to inform planning by developers, especially in the early years.”

This is a new industry with many lessons to learn. Many parks, just like Bristol, initially have to build awareness locally and nationally to attract visitors outside of the already active surf community. Aiming to make more than £2m in profit over the first year of business ignores the time it takes to amass a frequent following. Filling each surf session relies on highly capable marketing and sales efforts. To deliver the visitor experience consistently requires well-developed training and management across coaches and onsite staff. Therefore, the return on capital takes time to build up, particularly when the right expertise is yet to be put in place.

The Wave has now established more efficient ways of working, improved staff training, strong leadership, and effective communications and marketing approaches. A second site for The Wave will leverage that momentum and will benefit from a robust and transferable system. An outsider’s perspective doesn’t always see all the moving parts that fit together in balance, the lessons learnt along the way, and the potential pitfalls on either side of operations.

We are in discussions with two domestic locations and two overseas locations about supporting their wave park opportunities. We can provide marketing, ticketing, operational planning, systems, training, health and safety, recruitment, and customer service expertise to any site. We already have a full team able to support more than one location. Even if a park is fully funded and ready to go, we can save them money and risk in the build, take millions out of the set-up cost, and help avoid two years of pain when establishing a full operation.

If anyone is currently creating a new wave park, please get in touch. We’d be keen to further discuss our approach and find ways to collaborate.